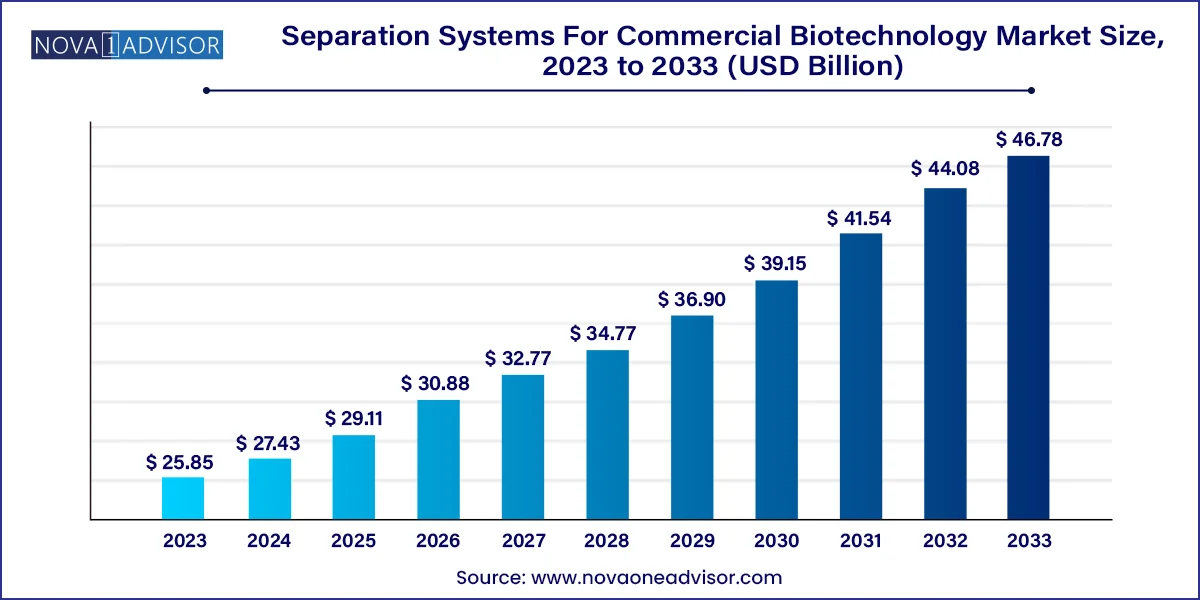

The global separation systems for commercial biotechnology market size was valued at USD 25.85 billion in 2023 and is anticipated to reach around USD 46.78 billion by 2033, growing at a CAGR of 6.11% from 2024 to 2033.

The Separation Systems for Commercial Biotechnology Market is a cornerstone of modern bioprocessing and plays a critical role in ensuring the quality, purity, and efficiency of biotechnological products. From pharmaceutical development to food processing and agricultural biotechnology, the demand for reliable and scalable separation technologies has never been more pronounced. These systems enable the isolation, purification, and refinement of biomolecules such as proteins, enzymes, hormones, and nucleic acids — all fundamental to product integrity and regulatory compliance.

Biotechnology has witnessed an exponential surge in industrial applications, particularly within therapeutic biologics, vaccine development, agricultural bioengineering, and specialty food production. This expansion has placed immense pressure on biomanufacturers to adopt advanced separation platforms that can support high-throughput, cost-effective, and contaminant-free processing. Traditional methods like chromatography, electrophoresis, and centrifugation are now being complemented by innovative technologies such as magnetic separation, biochips, and lab-on-a-chip solutions.

A key highlight of the market is its responsiveness to biopharmaceutical trends — especially the shift toward complex biologics, monoclonal antibodies, and recombinant proteins. Additionally, evolving regulatory frameworks such as cGMP (current Good Manufacturing Practices) and quality-by-design (QbD) paradigms demand enhanced process control, real-time monitoring, and superior reproducibility — capabilities that modern separation systems are increasingly offering. With commercial biotechnology extending its footprint into personalized medicine, cell therapies, and precision agriculture, the separation systems market is poised for sustainable and transformative growth over the next decade.

Integration of automation and digital analytics in separation workflows to improve scalability and minimize human error in GMP environments.

Growing adoption of single-use technologies and continuous processing in biologics manufacturing, requiring adaptable and disposable separation modules.

Surging demand for miniaturized platforms like microarrays and lab-on-a-chip for high-throughput screening and point-of-care diagnostics.

Emphasis on green and sustainable bioprocessing driving the preference for energy-efficient and solvent-free separation technologies.

Rising applications of magnetic separation in cell therapy and molecular diagnostics, offering high specificity and reduced processing times.

Increased reliance on multi-modal separation technologies that combine physical, chemical, and biological principles for enhanced purification accuracy.

Customization of separation systems for niche applications in vaccine purification, enzyme recovery, and hormone biosynthesis.

| Report Attribute | Details |

| Market Size in 2024 | USD 27.43 Billion |

| Market Size by 2033 | USD 46.78 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.11% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Method, application, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; QIAGEN; Horizon Discovery Ltd.; OriGene Technologies, Inc.; Oxford Biomedica PLC; SignaGen Laboratories; Flash Therapeutics; Takara Bio Inc.; Bio-Rad Laboratories, Inc.; System Biosciences, LLC.; Promega Corporation; F. Hoffmann-La Roche Ltd; Revvity; Catalent, Inc. |

The primary driver catalyzing market growth is the explosive expansion of the biopharmaceutical sector, especially the development of protein-based therapeutics, vaccines, and monoclonal antibodies. These biologics require meticulous separation and purification processes to meet regulatory requirements and ensure therapeutic efficacy. With over 50% of current drug pipelines involving biologics, there is a surging demand for robust separation systems that can deliver high product yield, minimal loss, and consistent quality.

For example, monoclonal antibody production typically involves multiple stages of purification — from clarification to affinity chromatography to viral filtration — all dependent on high-performance separation systems. The push toward personalized biologics and cell-based therapies further compounds the need for flexible, scalable platforms that can be configured to different molecular sizes, charges, and binding affinities. CDMOs and pharmaceutical firms alike are investing heavily in upgrading their separation infrastructure, often integrating real-time analytics and automated controls to enhance throughput while maintaining GMP compliance.

Despite its critical role, the adoption of advanced separation systems is often hindered by high upfront costs and operational intricacies. Traditional systems like high-performance liquid chromatography (HPLC) and ultracentrifuges require not only substantial capital expenditure but also skilled personnel for setup, calibration, and maintenance. For emerging markets and small-scale biotechnology startups, these expenses can create significant barriers to entry.

Moreover, certain separation techniques demand precise environmental conditions, complex buffer systems, and lengthy validation cycles. This makes integration into existing bioprocess lines challenging, particularly in multi-product facilities where flexibility is essential. In the case of modern methods like lab-on-a-chip or magnetic separation, while technically advanced, they may still face limitations in processing volume and regulatory acceptance, especially in large-scale commercial applications.

A compelling opportunity lies in the global shift toward continuous bioprocessing and single-use systems in commercial biotechnology. Continuous processing reduces downtime, improves efficiency, and enables real-time monitoring of product quality. This evolution is particularly beneficial in vaccine production, where rapid scale-up and purity assurance are vital. Separation systems that are compatible with continuous workflows, such as multi-column chromatography or tangential flow filtration, are rapidly gaining favor.

Additionally, the surge in contract manufacturing and modular facilities is boosting demand for single-use separation devices that reduce cross-contamination risks and enable flexible manufacturing strategies. Single-use centrifuges, membrane filters, and disposable affinity columns are being embraced for their convenience, compliance, and speed of deployment. As companies seek to reduce their carbon footprint and water usage, separation systems offering sustainable and modular solutions will see elevated demand.

Method Insights

Conventional methods dominated the market and accounted for a share of 69.29% in 2023 due to its unmatched precision, versatility, and scalability across biopharmaceutical applications. Whether through ion exchange, affinity, size exclusion, or reversed-phase formats, chromatography enables the selective purification of proteins, enzymes, and nucleic acids. Its dominance is underpinned by its widespread use in vaccine purification, plasma fractionation, and recombinant protein processing. The development of pre-packed and single-use columns has further solidified chromatography’s place in commercial biotechnology.

Conversely, lab-on-a-chip technology is witnessing the fastest growth, driven by its application in miniaturized diagnostics, point-of-care testing, and rapid screening. These systems integrate microfluidic circuits to manipulate small volumes of biological fluids, enabling swift separation, analysis, and even detection. Pharmaceutical R&D and food safety labs are increasingly incorporating lab-on-a-chip platforms for real-time analysis of molecular markers, allergens, and contaminants. Although still emerging, the scalability, cost-effectiveness, and automation potential of this method are positioning it as a future mainstay.

Application Insights

The pharmaceutical segment dominated and accounted for the share of 39.19% of the market in 2023 with vaccines and proteins accounting for the lion’s share. Given the heightened global focus on immunization — accelerated by the COVID-19 pandemic and recent advances in cancer vaccines — separation systems for virus-like particles, adjuvant removal, and cell debris clarification have become mission-critical. Human blood plasma fractionation, hormone purification, and mammalian cell culture downstream processing also rely on advanced separation technologies to meet regulatory and clinical benchmarks.

The food and cosmetics segment are projected to grow at a CAGR of 7.0% over the forecast period As genetically modified crops and bioengineered fertilizers gain acceptance, separation technologies are being utilized to refine plant-derived proteins, isolate microbial biofertilizers, and eliminate impurities in agrobiotech solutions. The rise of precision agriculture and demand for organic, bio-based products is further catalyzing investment in specialized separation tools that ensure safety, functionality, and yield optimization in agricultural innovations.

Regional Insights

North America, particularly the United States, dominates the separation systems for commercial biotechnology market, driven by its leadership in biopharmaceutical innovation, advanced healthcare infrastructure, and regulatory sophistication. The region is home to industry giants and research institutions actively engaged in vaccine development, monoclonal antibody production, and cell-based therapies — all of which rely heavily on efficient and compliant separation processes.

The U.S. government’s sustained investment in biodefense and pandemic preparedness, as well as its support for novel biologic platforms like mRNA vaccines, has spurred demand for high-performance separation systems. Additionally, the presence of a well-established contract manufacturing sector and robust venture capital ecosystem enables startups and SMEs to access cutting-edge purification tools via strategic partnerships and outsourcing arrangements.

Asia-Pacific is witnessing the fastest growth, fueled by biopharmaceutical expansion, government support for biotechnology, and rising demand for affordable biologics and diagnostics. Countries like China, India, South Korea, and Singapore are emerging as biomanufacturing hubs, attracting global companies to establish regional production and R&D facilities. These developments necessitate investment in separation infrastructure — from membrane filtration for vaccine purification to magnetic separation in diagnostics.

Furthermore, the growing middle-class population and healthcare expenditure in Asia-Pacific are catalyzing the localization of biosimilar and vaccine production, driving uptake of separation systems tailored for cost-efficiency and scalability. Initiatives such as India’s Biotech Parks and China's 14th Five-Year Plan are expected to further reinforce regional momentum.

The following are the leading companies in the separation systems for commercial biotechnology market. These companies collectively hold the largest market share and dictate industry trends.

February 2024 – GE HealthCare announced a partnership with Cytiva to co-develop a next-generation protein purification system for mRNA and DNA-based vaccines, integrating membrane filtration and magnetic bead technology.

January 2024 – Thermo Fisher Scientific expanded its chromatography resin production capacity in Massachusetts to meet growing demand from biopharma clients, aiming to reduce global lead times and enhance downstream processing efficiency.

December 2023 – Merck KGaA (MilliporeSigma) launched its new single-use tangential flow filtration system at CPhI Worldwide, tailored for small-scale vaccine developers and CDMOs seeking flexible purification modules.

November 2023 – Bio-Rad Laboratories acquired a minority stake in an emerging lab-on-a-chip startup specializing in microfluidic separation for food and environmental testing applications.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Separation Systems For Commercial Biotechnology market.

By Method

By Application

By Region